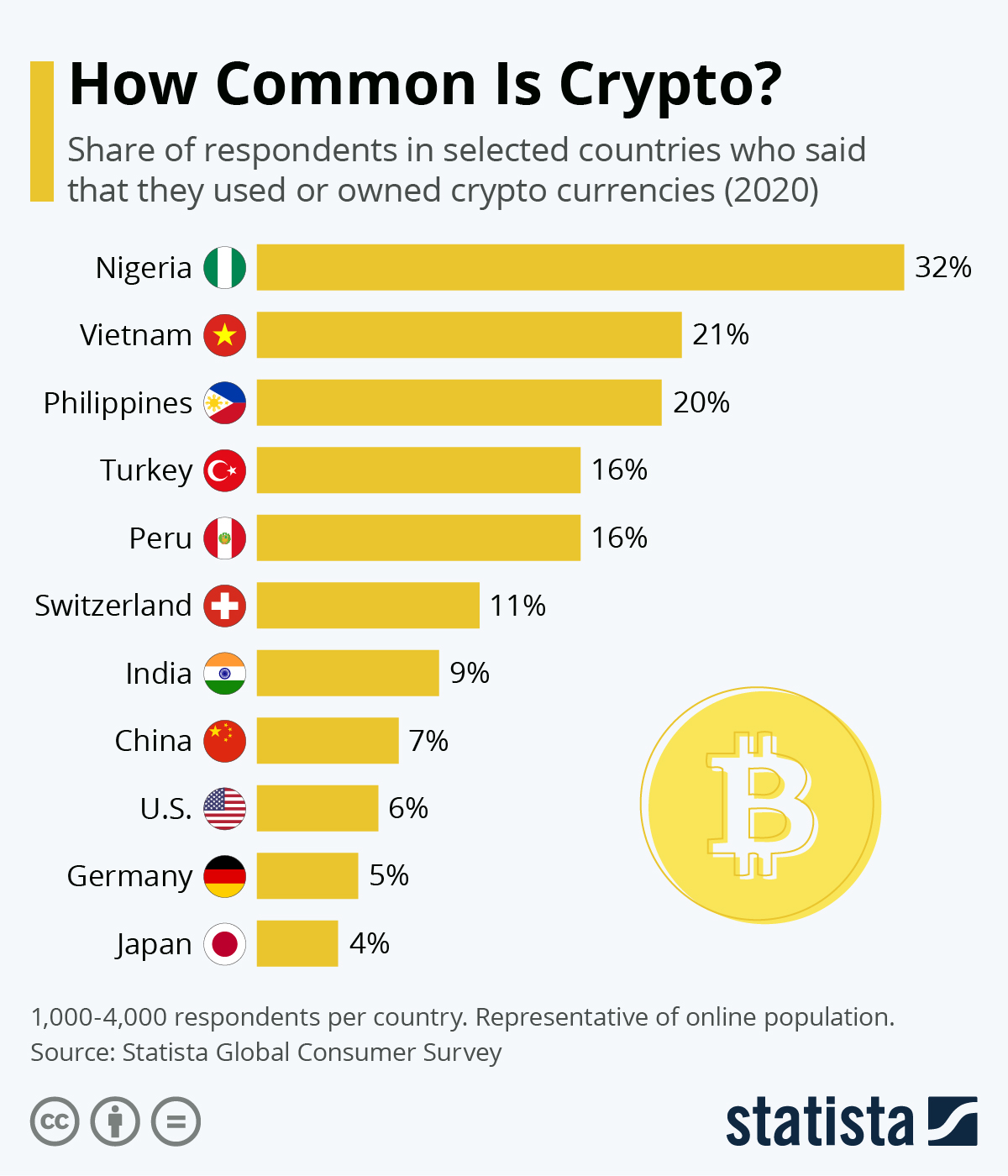

Chances are that 5 -10% of your customers own a cryptocurrency. But if someone wanted to pay with an alternative currency, is that something you could support? Or would want to support? With major companies like Microsoft, Starbucks, and Tesla experimenting with payment in cryptocurrency, now is a time for all companies to assess whether alternate payment methods are a value add for their customers.

The story of these virtual coins begins with one person: the cryptographer David Chaum. In 1983, Chaum developed a cryptographic system called eCash. Twelve years later, he developed another system, DigiCash, that used cryptography to make economic transactions confidential. However, the term "cryptocurrency" was coined was in 1998. That year, Wei Dai thought about developing a new payment method that used a cryptographic system and whose dominant characteristic was decentralization.

In the current decade, the most popular cryptocurrency is Bitcoin. Launched in 2009, Bitcoin has emerged as a trusted asset with major backers in the financial industry. Even if Bitcoin is the most popular, there are 100s of other cryptocurrencies, so-called altcoins, gaining popularity. This leaves companies struggling to keep up with the deluge of payment options. Regardless of what happens next with cryptocurrency, businesses should know the various benefits and risks posed by alternative payment methods.

Benefits

According to Deloitte, companies can realize multiple benefits by accepting cryptocurrency as a payment method:

- Crypto may provide access to new demographic groups. Users often represent a more innovative clientele that values transparency in their transactions. One recent study found that up to 40% of customers who pay with crypto are new customers of the company, and their purchase amounts are twice those of credit card users.

- Introducing crypto now may help spur internal awareness in your company about this new technology. It also may help position the company in this important emerging space for a future that could include central bank digital currencies.

- Crypto could enable access to new capital and liquidity pools through traditional investments that have been tokenized, as well as to new asset classes.

- Crypto furnishes certain options that are simply not available with fiat currency. For example, programmable money can enable real-time and accurate revenue-sharing while enhancing transparency to facilitate back-office reconciliation.

- More companies find that important clients and vendors want to engage by using crypto. Your business may need to be positioned to receive and disburse crypto to assure smooth exchanges with key stakeholders.

Crypto provides a new avenue for enhancing a host of more traditional Treasury activities, such as

- Enabling simple, real-time, and secure money transfers

- Helping strengthen control over the capital of the enterprise

- Managing the risks and opportunities of engaging in digital investments

- Crypto may serve as an effective alternative or balancing asset to cash, which may depreciate over time because of inflation. Crypto is an investable asset, and some, such as bitcoin, have performed exceedingly well over the past five years. There are, of course, clear volatility risks that need to be thoughtfully considered.

The next challenge is to determine whether your business should directly collect cryptocurrency payments, or work through an intermediary. Some companies use crypto just to facilitate payments. One avenue to facilitate payments is to convert from crypto to fiat currency to receive or make payments without actually touching or holding it. In other words, the company is taking a “hands-off” approach that keeps crypto off the books.

Enabling crypto payments, such as bitcoin, without bringing them onto the company’s balance sheet may be the easiest and fastest entry point into the use of digital assets. It may require the fewest adjustments across the spectrum of corporate functions and may serve immediate goals, such as reaching a new clientele and growing the volume of each sales transaction. Enterprises adopting this limited use of crypto typically rely on third-party vendors.

There are two paths a company can follow when embarking on a broader “hands-on” adoption of crypto:

- Use a third-party vendor or custodian to maintain custody of the crypto on a blockchain and provide wallet management services that facilitate the tracking and valuation of the crypto assets.

- Integrate crypto into the company’s systems and manage its private keys. (Consult your legal counsel to determine whether they will require any license to enable the transmission of crypto.)

How a company accepts alternative payments, and the methods they use to process the transactions are important questions. But they are secondary to whether or your company should support alternative currency payments. Cryptocurrencies present unique benefits to businesses, as highlighted above. In the next section, we delve into the unique risks that alternative currencies may pose.

Risks

Accepting cryptocurrency means setting up a digital wallet on a digital currency exchange, which could be technically prohibitive for small business owners unfamiliar with the technology. Cryptocurrency is an information-dense field with a relatively high learning curve, which can present a significant obstacle when you are also trying to run a business.

The highest risk of digital currencies is price volatility, which makes value extremely unpredictable. To illustrate, Bitcoin was first valued in pennies when introduced in 2009 but is currently worth approximately $33,000 per coin, down from $60,000 three months prior.

Although cryptocurrency transactions eliminate cyber threats like stolen credit card numbers, the currency still is not 100 percent safe. So far, there is no way to completely prevent cybercriminals from getting their hands on users' wallets. This is dangerous because, unlike fiat currencies like the U.S. dollar and the Euro, central governments rarely back cryptocurrencies (China with the digital Yuan and El Salvador with Bitcoin are notable exceptions) and are more difficult to insure.

Another issue with accepting cryptocurrency is that the regulatory landscape is subject to changes in the near future. Lawmakers are still crafting regulations to govern it. Once regulations are in place, they are likely to develop further, meaning business owners will have to be adaptable.

What is right for your business?

Cryptocurrency as an acceptable payment type is not right for every business. A key driver of any new payment method should be the customers you serve. If having alternate payments is important to them, that is a great indicator that it should be important to you as well.

The larger question may just be if cryptocurrency continues to gain popularity and adoption, how long will it be until a business has to accept it or risk losing market share? If central banks introduce digital versions of the national currency, will your business be required to accept it? Answering these questions will probably take years, after which the path forward will become clearer. In the interim, every business should add cryptocurrency to their list of technologies that they are paying attention to.