When people hear the phrase “insurance industry,” what comes to mind? Television commercials with memorable lead characters? Telemarketing calls and junk mail? Monthly insurance payments with little perceived value in return?

Most adults have only a vague sense of what our industry is, what it does, and how it works. Society views basic insurance tools such as auto and life insurance as the necessary evils of adulting; that is about as far as most people go in their insurance awareness.

Insurance flies well under the pop business culture radar. Property and Casualty Insurance companies in the United States generate over $700 billion in annual revenue. This is premium only; it does not include revenue generated by insurance agencies, third-party administrators, premium audit companies, and other insurance entities.

Yet despite the outsized economics, and even though insurance is need-to-have versus nice-to-have and is, therefore, an industry with staying power, most people do not consider the P&C insurance industry as a career option for employment.

That’s a problem. People don’t apply to jobs they don’t know about, at companies they haven’t heard of, in businesses they don’t understand.

As a hiring manager or business owner in the insurance industry, hiring someone for an insurance-related job is difficult. Our industry is beginning to get traction in the labor market, but for most of the working population, P&C insurance remains obscure, arcane, and not top of mind.

Insurance business owners and managers are striving to resolve this issue after years of industrial inertia. To creatively solve for x in attracting new talent while we ourselves are in mid-career. “Hey, I didn’t sign up to save an industry,” you’re thinking. And yet, here we are.

Most people do not know how fascinatingly intricate the insurance industry is. Our very large industry somehow is a well-kept secret. How can we attract people from outside the insurance industry into the insurance industry?

Here is a practical hiring approach to finding people who are not yet in insurance. The idea below will not solve the industry’s employment concerns; it is a pragmatic approach to solve your hiring need. Quickly and creatively. If we get at it one job at a time, one person at a time, then eventually industry transformation just might occur. So, let’s get at it.

PART 1: The Brainstorm

When you are hiring, the first goal is to reach out to people with relevant skills who are likely to be interested in the job. How do you do this?

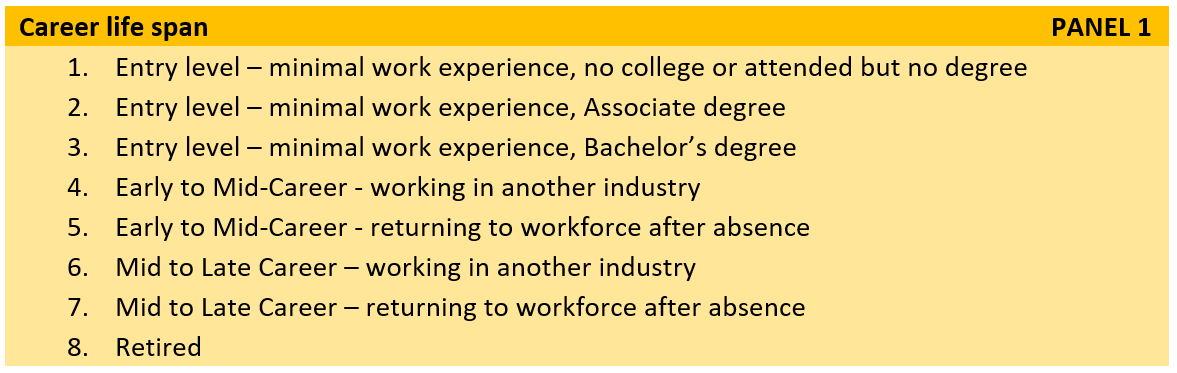

Picture a career as having a life span: a career can begin as early as high school graduation and for our purposes, will end in retirement. Consider all the points on the career timeline for your current hiring need. Check against your fundamental assumptions by imagining a person from each phase doing the job for which you are hiring. Can each career phase be a possibility? Assume “yes it can” and then imagine the “how”. Don’t rule it out without playing it out. (Caveat for regulatory requirements: if a CPA, JD, other degree or certificate or designation is required, that places parameters on your options.)

Professionally proximate people: who do you interact with in your business? Think specifically of non-insurance people and companies. The list below might work for you or use it to jumpstart your own:

Diversity of thought and experience: Imagine building a great team. You will want people with varying ideas and perspectives. What employment-related channels can you leverage to contact each group of people? Search for online job boards and professional associations that serve various diversity niches (find the local chapter of these groups as well as the national organization). Yes, there are deeper strategies and more meaningful around diversity, but this is a good start for a quick actionable way to increase the breadth of your search for new employees. It is amazing how many online and community resources there are for reaching out to people in the groups below.

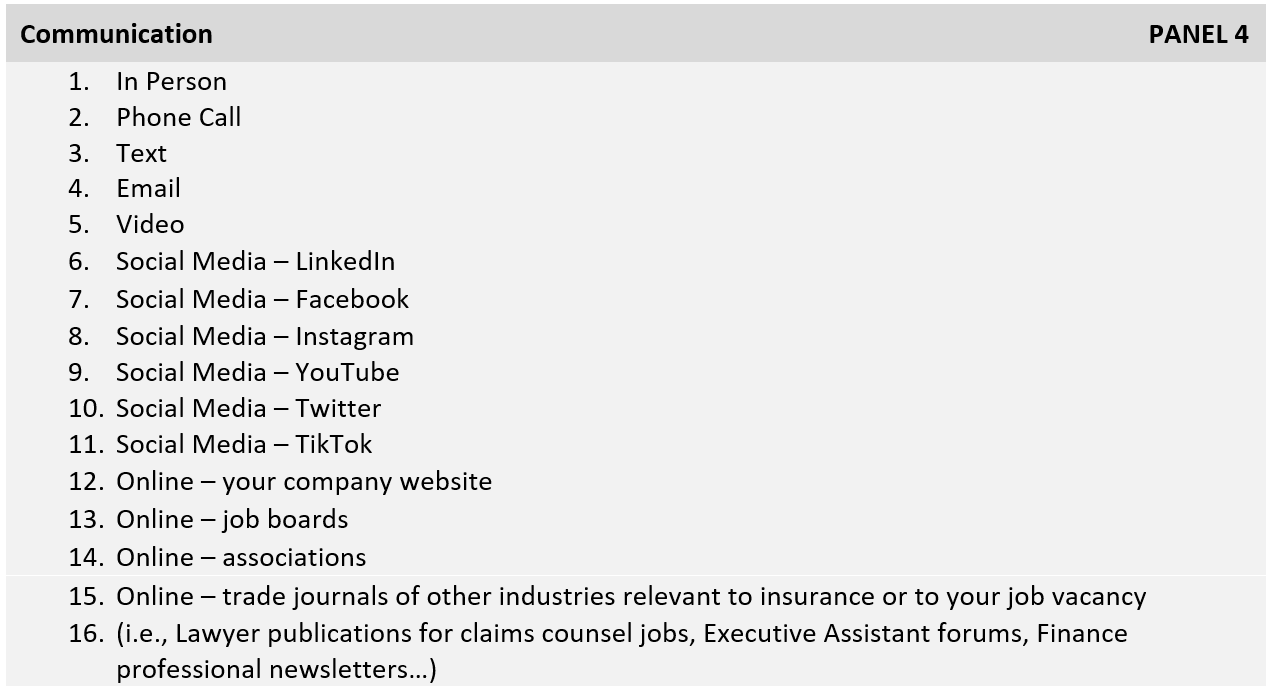

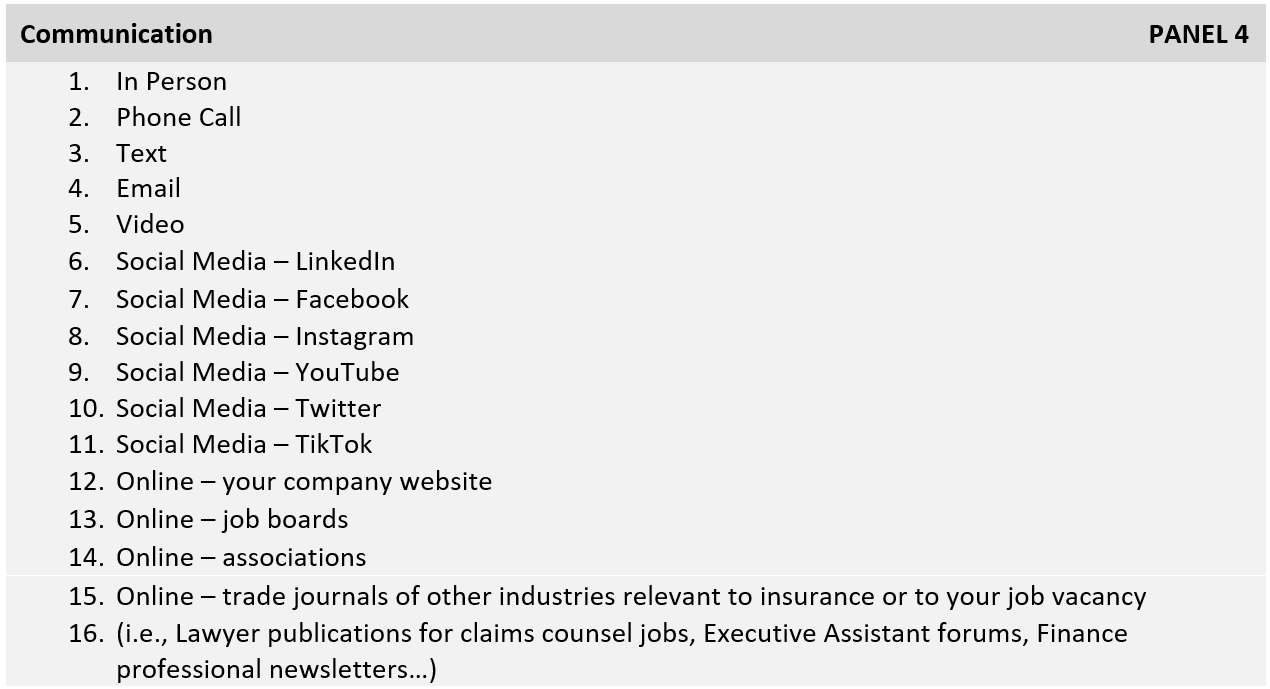

Communications - And finally, how will you broadcast your message about your insurance job?

PART 2: The Combination–PANELS 1, 2, 3

Consider your open job. Let’s say it is a Property Claims Adjuster. Look at the first two Brainstorm panels:

Choose one row from each panel:

Example: Early to Mid Career working in another industry + Facilities

Combine these ideas. This might lead you to think about the people who work in groundskeeping at your building, or perhaps the property manager, or the procurement person who deals with all the maintenance vendors. These are people you can talk, text, email with to assess their own interest in and fit for your job, and you can get ideas and referrals from these conversations. You can contact facilities teams at other buildings, industrial parks, etc. now that you are off and running with this idea. Let this outreach idea naturally grow and develop.

Here is another example, this time for an Underwriting Assistant:

Choose one row from each panel:

Example: Entry level + Finance

Combine these ideas. Who are people with an entry-level finance job? Expand “finance” to include anything financial, so, for example, a bank teller, a cashier, someone who works in the finance office of a car dealership processing loans. In your job, do you interact with payroll teams, collection agencies, tax professionals who are new to the workplace? Let your imagination fly–that is the point of these combinations.

Now Add Panel 3, Diversity:

Let’s use the Underwriting Assistant job. This was Entry level (PANEL 1) + Finance (PANEL 2).

Now add Age/Generational. Hmm… maybe this is a job where you could consider someone who is older but with little work experience. So still entry-level but from a different point of entry in their life.

Add Race/Ethnicity. Reach out to people of various ethnic backgrounds. Post to a Latino job board, a Black job board, an Asian job board. Better yet, an insurance industry minority job board (that phrase right there is your Google search). From what ethnic groups are the people who live near your job site? Reach them. Go to their community meetings, to their volunteer opportunities. If your job is remote, even better–diversity is then independent of location. Yes, the topic of diversity is much broader and deeper than posting on a job board and having superficial interactions based on recruiting people for a particular job. But this is a start. It is a way to increase the applications to your job, to increase your candidate pool and the diversity of your team.

PART 3: The Implementation–PANEL 4

We can use all the above for outreach about your job. What channels apply to the audience you want to reach? Think about the form of each medium: your email is not the same message as your text, which is not the same message as your Facebook or LinkedIn post. Be mindful of the length and tone (formality vs. casualness) of each method.

You’ve hired a newbie–now what?

Don’t abandon your new hire! The intricacies of the insurance industry make it a fascinating arena. But they also are overwhelming to absorb in a timely, efficient way–especially for a new employee who is trying to learn all the details of their new role and company.

Your new employee’s endeavor of taking on a new industry requires mentorship, a “structured availability” in which you are a tour guide, preventing misunderstandings and missteps along the way.

Appreciate our industry from a beginner’s eyes: many idiosyncratic and weirdly wonky conventions exist in insurance. This is really cool when you are “on the inside” and can see the matrix, but it is a little weird when someone is on the outside looking in. The jargon runs deep.

Here is what we in the insurance industry take for granted as fundamental and foundational concepts:

- The supply chain concepts of brokers and underwriters, personal and commercial lines, admitted and excess.

- The financial structure of statutory and GAAP accounting, premiums, commissions, reserves, loss ratio, combined ratio, LAE

- The risk management structures of fronting, reinsurance, and captives

- The renaissance and remarkable changes in how technology is used by the insurance industry

- The complex regulatory environment of insurance, its many governing bodies and statistical services, and its federal and state legislative requirements

And yes, our ability to meet unexpected demands is our industry’s super-flex: we adapt both in crisis and through evolution. The insurance industry has quickly addressed customers' needs with solutions and products in technology, cyber, and data insurance; in pandemic-related products such as business interruption and workers’ compensation; in societal and governmental issues such as climate response and terrorism; in new customer-driven areas, such as parametric and embedded insurance.

Conclusion

Insurance is like the type O blood of job search–it is an almost universal option for career considerations. There are literally thousands of career paths within insurance.

An insurance career provides insight and interaction with many other industries, and perhaps extensive travel and global opportunities. It provides insights into communities–the stories, and the fabrics of towns, business owners, and families. The P&C industry is rich with opportunities to learn, engage, and make a difference. The Property and Casualty insurance industry is an exciting portal into the industries, geographies, and lives of our insureds. Go share the news with the people not yet in insurance and bring ‘em aboard.

Special thank you to the author of the article, Audry Torrence, who is an Executive Vice President at Stephens Rickard Ltd., an executive search and recruiting firm serving the property and casualty insurance industry. She is passionate about contributing to the industry and can be reached at audry@stephensrickard.com or through LinkedIn and Twitter.