On July 2nd, 2020, a shockwave rippled across the technology landscape, as a few newly minted millionaires took stock of their fortunes. Simultaneously, individuals in Silicon Valley and New York met in private for celebratory cocktails. Major publications across the world reported the event including Forbes, Reuters, and the Financial Times.

At 8am eastern standard time, Lemonade went public. Lemonade’s IPO represents the first time a new, tech-backed, venture-funded insurance carrier has become a publicly-traded company.

Lemonade’s success is a harbinger of good things to come for other insurance technology (insurtech) companies.

Lemonade’s success in going public is significant to insurtech startups:

- It shows the allure of insurtech for investors.

- While personal-lines insurtech, like Lemonade, have received the lion's share of private investment, this will soon change.

For more information on why insurtech matters and what it is, see this earlier article.

Behind all successful startups stand early-stage venture firms and angel investors, which provided critical early funding that allows them to get off the ground.

It’s these early-stage investors that decide which ideas are most viable, and by providing early investment give funded startups a fighting chance. With Lemonade’s successful exit, the coffers of insurtech investors have been replenished and the viability of insurtech as a venture backable category has more credence. As investing in insurtech startups as a thesis is relatively new, Lemonade’s IPO will also attract new investors to the space, buoying insurance startups looking for funding.

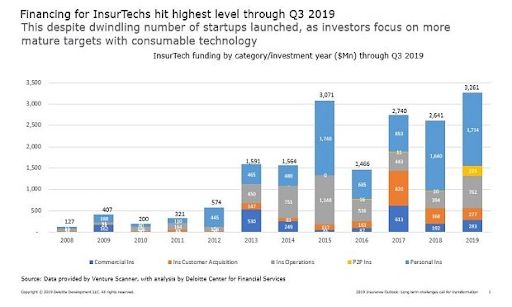

Year-over-year, private investment in insurtech has exploded. It is expected though that insurtech investment will decline along with tech investment as a whole in 2020 because of COVID-19, but will be one of the first to bounce back.

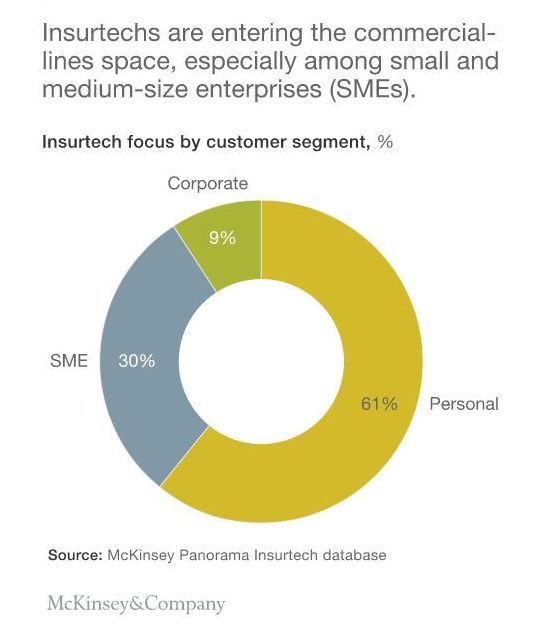

Insurance is broken into two major areas: personal and commercial lines. To date, ~80% of private investment has gone to the personal-lines side of the business.

The reason for this is that disrupting prior insurance sales models by building direct-to-consumer insurance products allowed for quick growth. The early success of Lemonade, and Hippo, another insurtech startup, which plans to file for IPO in 2021, has created a gold rush for new personal-lines focused insurtech startups seeking to capitalize on the opportunity.

Existing insurance companies, facing this disruption, have begun getting more tech savvy, building out their own direct-to-consumer companies. Exemplifying this is Toggle, a wholly owned subsidiary of Farmers Insurance going head-to-head with Lemonade for the renters market.

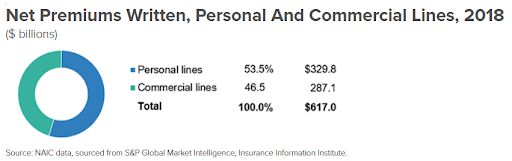

As the established insurance industry has become more innovative, opportunities for insurtech startups in the commercial lines space have increased. The driving force for commercial lines focused insurtechs is that commercial lines bring in almost as much revenue as personal-lines.

As an investment opportunity, insurtech startups in the commercial space hold more promise over their personal-lines brethren.

Not only is there less competition because the space is more nascent, but the need for innovation in commercial insurance is also greater. This TechCrunch article “Commercial insurtech is like an exclusive club — and Google and Amazon aren’t invited” does an excellent job at explaining why innovation in commercial insurance will create the next startup unicorns.

While few investors expect insurtech to weather the current instability unscathed, existing insurance companies have warmed up to sharing their data and internal business processes with commercial insurtech startups to achieve increased efficiency and revenue. Investors should take notice of this, otherwise they risk missing the next big opportunity: commercial insurtech.